TheMint is a free online personal finance service that helps one to manage their finances effectively. Over time, Mint has grown stronger and has become more useful to people. Mint.com is a very popular service with over 10 million users. It offers a perfect blend of money management tools and ease of use.

Here’s everything about Mint:

Getting Started

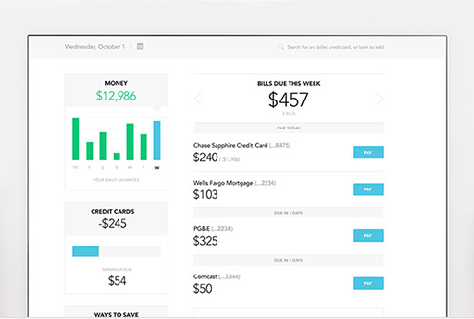

Mint.com comes with an intuitive interface and it is very easy to get started with the service. It takes a few minutes to set up accounts. The overview page shows your account balances, activity alerts, financial goals and more. It is easy to navigate with top tabs for different sections like Overview, Transactions, Budgets, Goals, Trends, Investments and Ways to Save. Mint connects directly to all financial institutions as every transaction appears in the ledgers. The transactions are automatically categorized and when you need to make some changes, you can do it once and Mint will do it that way.

Working with Mint

Mint comes with a clean and colorful interface and has been designed in such a way that you cannot get lost. The dashboard is also clean and provides you a quick summary of every element of your finances with one look. It calculates your net worth and displays it at the top of your account, providing you complete control over what is and is not included. You can effortlessly keep track of your spending and allocate income to the budgeting categories.

Personal Finance Reports

On the Trends page, Mint offers you a variety of simple and customizable reports. Here, you can view your all of your spending and can filter reports by several criteria. The flexibility to run pie charts for monthly, quarterly or yearly spending reports is a great plus.

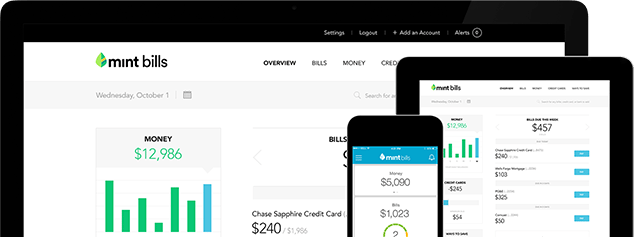

Multi-device access

Mint allows one to access from any device for on-the-go finance organization. This enables you to keep an eye on your money and gain easy access to alerts, budget etc. Your account can be accessed easily from your iPhone, Droid, Mac, or even a tablet (iPad or Android). Managing finances has never been that easy and hassle-free!

Pros:

- Completely free

- No software to install

- Real-time transactions and balances at one place

- Graphs and charts

- Bill reminders and text alerts

- Automatic downloaded transactions

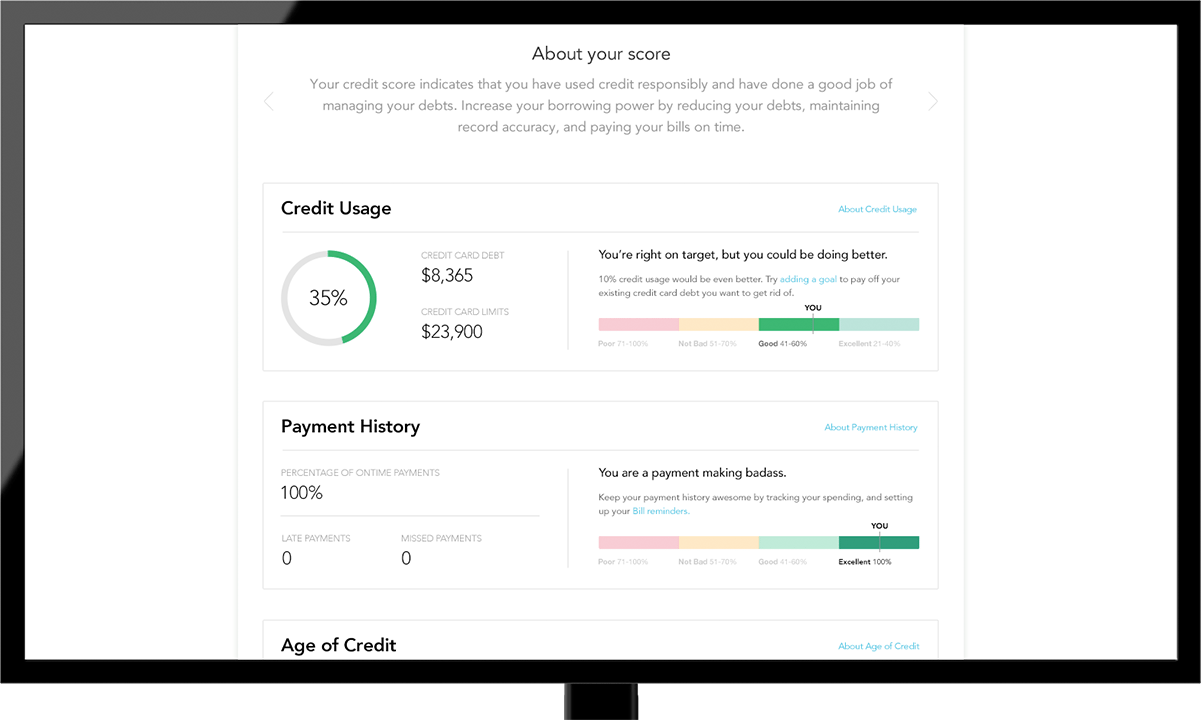

- Credit score tracking

- Mobile app support

Cons:

- Lack future spending features

- Income and expense assignments are not completely accurate

- Synchronization issues

- Cannot import data from other personal finance app

- Cannot reconcile against monthly bank statements

Final Words

Mint.com is a free service and is truly a superior product. There are no annoying contracts or long term commitments required. Whenever a bill is due, or when credit card charges are incurred, it notifies you about everything. You get to know where you are spending your money in a better way and allows you to watch for any fraudulent activity on any of your accounts. All-in-all, Mint is great for creating and tracking your budget and credit score.

Do you use Mint? What has been your experience of using it? Let us know your thoughts in the comments!

If you like our content, please consider sharing, leaving a comment or subscribing to our RSS feed to have future posts delivered to your feed reader.

Please follow us on twitter @CodeRewind and like us on facebook